Introduction

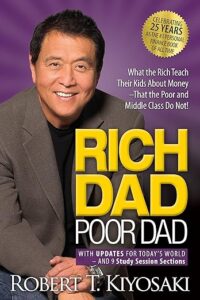

Has it ever occurred to you why some people achieve financial success while others live lifelong financial struggles? Robert Kiyosaki addresses this question in his book Rich Dad Poor Dad by contrasting two distinct perspectives on wealth: his best friend’s father’s (Rich Dad) and his own (Poor Dad). For millions of people, this book has changed their perspective on wealth, money, and financial independence.

This blog post will discuss the main takeaways from Rich Dad Poor Dad, how to put them into practice in everyday life, and why anyone hoping to better their financial future should read this book.

Rich Dad and Poor Dad: Who Are They?

The two father figures Robert Kiyosaki had as a child had quite different views on money:

His biological father, Poor Dad, was a highly educated man who struggled financially despite holding a steady government job. He supported the conventional route, which entails obtaining a solid education, landing a stable job, and putting in a lot of effort to earn money.

His best friend’s father, Rich Dad, is an investor and businessman who made wise financial choices to accumulate wealth despite having little formal education. He focused on entrepreneurship, investing, and financial education while teaching Kiyosaki how money works.

Through these divergent perspectives, Kiyosaki discovered that managing, investing, and growing your money are more important factors in financial success than your income.

Important Takeaways from Rich Dad Poor Dad

1. The Value of Education in Finance

Financial literacy is where the rich and the poor diverge most. While math and science are taught in schools, students are rarely taught money management, investing, or wealth-building techniques.

Takeaway: Learn about investing, read books, and listen to podcasts to begin educating yourself about finance.

2. Strive for Knowledge Rather Than Money

The wealthy concentrate on developing skills that can boost their income, while the majority of people work hard just to get paid. Kiyosaki was encouraged by Rich Dad to look for opportunities in sales, investing, and entrepreneurship that would give him useful experience.

Takeaway: Put your attention on learning financial growth-oriented skills like leadership, investing, and marketing.

3. The Distinction Between Liabilities and Assets

Knowing the difference between an asset and a liability is one of Rich Dad Poor Dad’s most important lessons:

Real estate, stocks, and businesses are examples of assets that put money in your pocket.Liabilities, such as credit card debt, mortgages, and loans, cost you money.The majority of people believe that their home is an asset, but if it is actually costing them money rather than bringing in money, then it is a liability!

Takeaway: Rather than merely working for a paycheck, concentrate on building assets that produce passive income.

4. The Influence of Passive Income and Entrepreneurship

The wealthy make money work for them, not the other way around. They invest in companies, stocks, and real estate to create passive income rather than depending only on a salary.

Conclusion: Begin to think beyond a 9–5 job. Seek opportunities to generate several sources of income through real estate, side ventures, or investments.

5. Getting Over Your Fear and Taking Chances with Money

Because they fear losing their money, many people never become financially independent. Failure is a necessary component of learning, according to Rich Dad. The secret is to learn from your mistakes and take measured risks.

Conclusion: Don’t allow fear to prevent you from making investments or launching a company. Learn, take calculated chances, and gain self-assurance overTime.

How to Use These Teachings in Everyday Situations

Enhance Your Financial Knowledge by reading books, enrolling in online classes, and tuning into financial podcasts.

Start Investing: Start with modest stock, real estate, or side business investments.

Reduce Liabilities: Get rid of pointless debts and concentrate on buying assets that will bring in money.Change your perspective from “I can’t afford it” to “How can I afford it?” to cultivate a wealth-building mindset.

Common Financial Myths Dispelled in the Book

1. “Financial Security Is Associated with High Salary”

Many people believe that financial security is guaranteed by earning more money. However, you will always be living paycheck to paycheck if you spend all of your income. The truth is that prudent money management and investment, not just a high income, are the keys to financial security.

2. “Purchasing a Home Is Always Beneficial”

The best financial investment, according to many, is home ownership. Your home is a liability rather than an asset, though, if it doesn’t bring in money.

Reality: The best way to increase wealth is to invest in cash-flowing companies or rental properties.

3. “The Wealthy Are Simply Fortunate”

Those who are wealthy are often assumed to have been fortunate or born wealthy. In actuality, the majority of prosperous people amassed their wealth via astute financial judgment, perseverance, and lifelong learning.

Reality: Knowledge, self-control, and taking measured risks are the keys to building wealth.

Reactions and Disputations

Despite its widespread praise, Rich Dad Poor Dad has its detractors. Some contend that Kiyosaki’s counsel lacks concrete, doable steps and is overly idealistic or general. Others point out that the story seems more fictional than factual because it is still unclear who his Rich Dad is.

Millions of people have used the book’s fundamental lessons to reevaluate their financial practices and begin their path to financial independence in spite of these critiques.

Conclusion: Is It Worth Reading Rich Dad Poor Dad?

Of course! This book is an excellent place to start if you want to overcome financial difficulties and begin accumulating wealth. It questions conventional wisdom regarding money and challenges readers’ preconceived notions about earning, saving, and investing.

Who Ought to Read This Book?

young professionals who wish to establish a solid financial base. business owners and entrepreneurs hoping to increase their wealth.Anyone who wants to become financially independent but is caught in a never-ending cycle of paychecks.

The Most Important Lessons

The secret to building wealth is financial education.Prioritize accumulating assets rather than merely a paycheck.Think like an investor, take chances, and learn from mistakes.

You can alter your financial future and strive for true financial independence by putting Rich Dad Poor Dad’s lessons into practice. 🚀

Do you think these lessons are correct? Do you have a copy of Rich Dad Poor Dad? Leave a comment below with your thoughts!